In the latest release of Cloze, we make it easier than ever for brokerages to drive core service revenue with built-in client introductions and AI-powered mortgage prompts—plus new process improvements to help track and progress lead and deal follow-up, as well as a host of new marketing email upgrades, and more!

These new Cloze Enterprise Plan features are available immediately on iOS, Android, and desktop (cloze.com).

Drive Core Service revenue with built-in client intros

With transaction volume down and the market more competitive than ever, brokerages need more than commissions to stay profitable—core services like mortgage, title, and insurance are now essential. But you’re not the only one eyeing that revenue—tech giants like Zillow and Rocket are after the same dollars, using data and scale to get there first.

And of course, restrictions around incentivizing agents to make referrals makes fighting against those tech giants even harder. Cloze’s latest release helps you fight back by making it easy for agents to introduce your in-house providers—right from their daily workflow. Savvy agents recognize that keeping clients within the brokerage’s ecosystem increases the chance of maintaining the relationship for the future. Meanwhile, for the brokerage, more consistent introductions mean higher capture, greater margins, and less revenue lost to competitors.

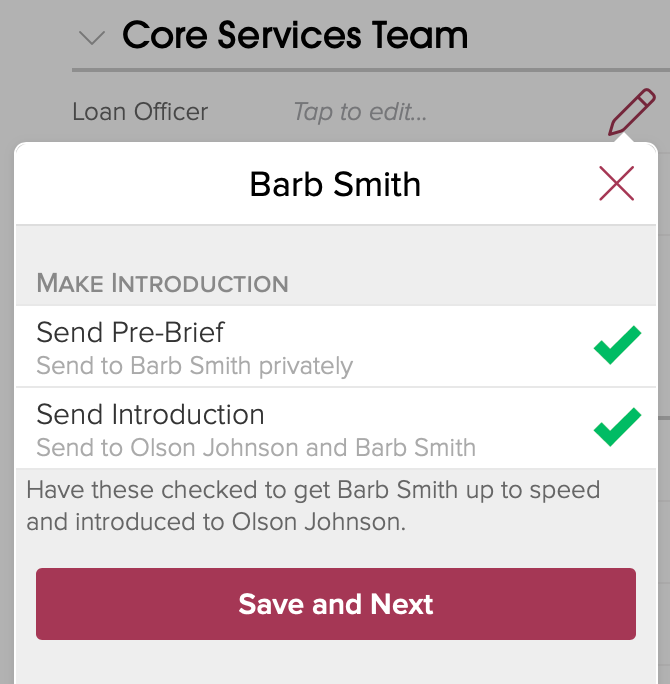

Cloze makes it easy for agents to refer clients to your preferred service providers—without ever leaving the app.

- Built-in list of trusted partners: Cloze includes a preloaded directory of your approved providers, like loan officers or title reps, so agents never have to search for contact info or guess who to refer.

- Simple, guided introduction flow: Agents use a two-step, wizard-like process to brief the provider (step 1) and then introduce them to the client (step 2), using built-in email templates that make it fast and easy.

- Personal, high-conversion handoffs: Because the agent sends the intro directly, the handoff feels natural and personalized—which boosts follow-through and capture rates.

- Customizable for every stage: Brokerages can tailor the services shown—pre-sale or post-sale—so the right options appear at the right time.

The result: more referrals, better client experience, and higher core service revenue—all with fewer missed opportunities.

How it works

- Pick a provider – Agents select from a built-in list of your brokerage-approved mortgage, title, or warranty partners—no digging or guesswork.

- Send a quick brief – Cloze walks agents through a quick message to get the provider up to speed before the intro.

- Make the introduction – Cloze then provides a ready-to-send email template to introduce the provider directly to the client.

Because the agent sends it themselves, clients are more likely to respond, helping drive higher response and capture rates.

Cloze AI helps agents spot mortgage opportunities automatically.

Clients don’t always raise their hand when they need financing, but their messages often tell the story. Cloze analyzes conversations to help agents spot these signals early and act fast, without the guesswork.

How it works:

- Scans conversations for signals – Cloze reads email threads to detect when a client mentions getting prequalified, needing a lender, or seeking a second opinion.

- Flags likely opportunities – When the AI finds one, it prompts the agent with a simple alert.

- Connects to your in-house lender – The prompt ties into Cloze’s introduction flow, making it easy for the agent to pre-brief and introduce a trusted provider.

- Keeps things personal – The agent sends the intro directly, so it feels like a helpful recommendation, not a handoff to a robot.

More timely, personalized introductions lead to more clients choosing your mortgage services—and higher core services revenue.

One-tap updates that keep deals tracked and on track

While Cloze automates a lot behind the scenes, some moments still need a quick check-in from the agent. For example: Did the lead show up for their appointment? Why has a lead gone cold? A quick update from an agent helps track progress accurately and continue to automate next steps. Cloze’s new progression automation makes it easier for agents to keep deals moving with simple Yes/No questions—and for team leaders to track progress without micromanaging.

By adding simple, tappable questions into campaigns, Cloze turns common decision points into clear next steps. Whether it’s checking if a meeting was booked or prompting an introduction to a loan officer, agents can answer in one tap, and Cloze takes care of the rest—branching the campaign down the appropriate path, updating the record, and keeping everything on track.

Cloze’s Yes/No question steps makes deal and lead follow-up progression transparent, simple, and trackable.

Here is how it works:

- Add a decision step to any campaign automation – Insert alerts like “Recommend a loan officer?” or “Has the meeting been booked?” directly into agent campaigns.

- Notifications encourage progress – Push and text notifications ensure agents answer these questions, instantly updating the campaign without any extra work on their part.

- Agents tap their answer – Agents respond Yes or No right from their Agenda—answers can also trigger actions (fill fields, send intros, or adjust next steps) to collect more information.

- Each answer guides the next step in the client journey – Each response routes the contact down a custom path—update statuses, record lost reasons, or launch follow-on tasks.

- Leaders get the visibility they need – Questions and answers appear in each contact’s profile and timeline, and update analytics letting team leaders easily see deal status and agent activity.

Marketing email enhancements

- Column dividers – add a divider between columns.

- Edge spacing – set the spacing to the edge of the column.

- Mobile alignment enhancements – additional options to refine alignment when viewed on a mobile device.

- Composite images – layer one image on top of another.

- Customizable link styles – set custom theme styles for links.

- Auto-archive templates – option to add an expiration date to a template so content can be archived automatically.

- Add coaching content to templates – Add tips and other recommendations on how to use a template.

- Share marketing templates with a preview link – New option to save an email template as HTML and share the template URL with others.

Other features included in this release

- Filter out all-day meetings from the Agenda – Agenda customization option to hide all-day meetings.

- Sort dates by either anniversary (day+month ignoring year) or exact date

- Anniversary (day+month ignoring year) – Helpful if you simply want to sort by upcoming anniversaries — (e.g. a wedding anniversary or real estate review).

- Exact date – Helpful if you want to know the exact year something occurred, like a home purchase.

- Export only selected table view columns – Option to export only the visible columns in the table view.