This is the second post in our three-part series introducing The Connected Brokerage. If you missed it, start with Part 1, which highlights the market imperative driving adoption of The Connected Brokerage, and then continue on to Part 3, which covers the technology that helps make The Connected Brokerage possible. For a pdf eBook of the full series, click here.

In our last post, we explored the significant challenges brokerages face in the current environment and why the prevailing approach to client acquisition and engagement is failing to deliver the growth and profitability brokerages need to survive.

In this post, we start to explore the concept of the “Connected Brokerage”—what it is, and how it can help brokerages drive that profitability.

Before we dive into the details, we need to first define what we mean by the term “Connected Brokerage.”

The Connected Brokerage business model enables forward-thinking real estate firms to grow profits, build client loyalty, and stay flexible — without needing to change everything at once. It allows agents and brokerages to combine personal connections with organization-wide insights, creating a more consistent and valuable client experience.

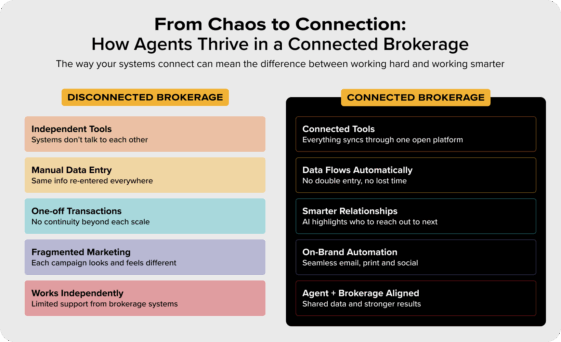

By connecting key tools and systems—like websites, CRMs, marketing platforms, transaction tools, back-office operations, and core services—the Connected Brokerage can deliver one unified view of the business, the client, and the market.

With everything working together, brokerages can shift their focus from transactions to long-term relationships that help agents drive referrals and repeat business, and even generate continuous revenue for the brokerage in the form of core services. It allows agents and brokerages to combine personal connections with organization-wide insights, creating a more consistent and valuable client experience.

This approach helps brokerages earn more, from more frequent referrals to higher rates of repeat business to increasing capture rates on services like mortgage, title, and insurance. And because it’s flexible, it’s easier to adapt to shifting market conditions, regulatory changes, and rising customer expectations—without slowing down the business.

Redefining the client relationship

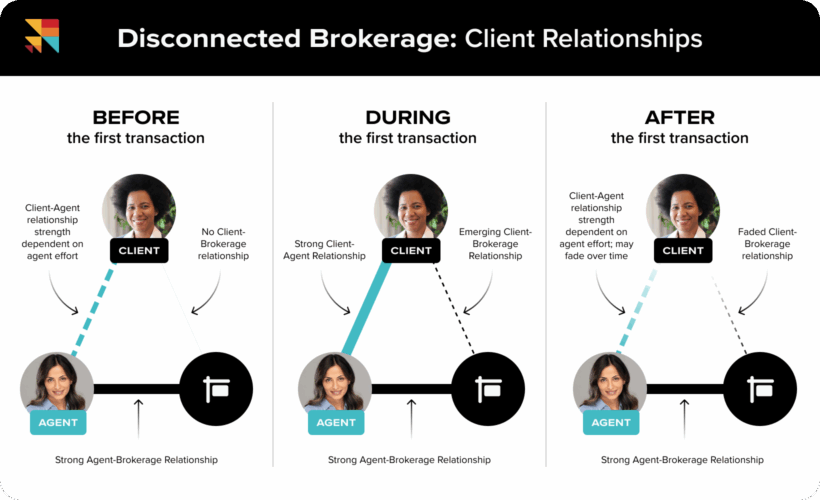

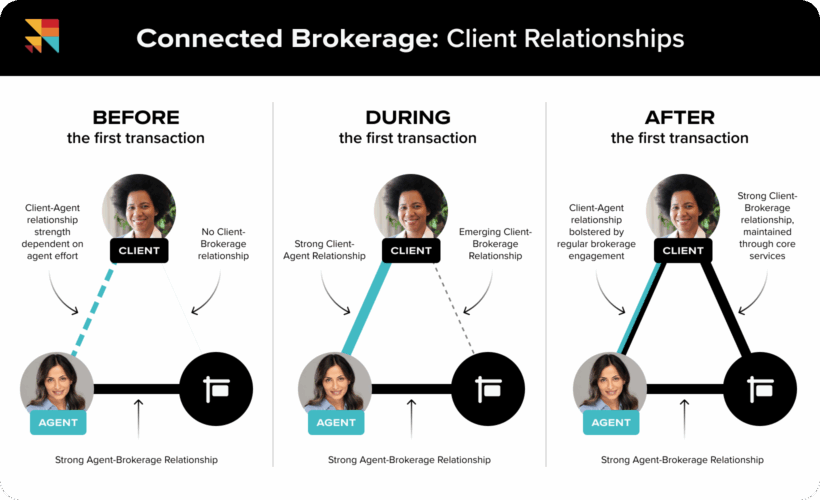

To stay competitive over the long term, brokerages need to build a direct connection with clients—one that works alongside the agent’s relationship. When the client relationship is left to the agent, the brokerage loses the chance to deliver value beyond the initial sale. That’s because agents often don’t have the time or incentive to maintain a continuous relationship or cross-sell after the transaction.

Typically, agents manage a direct relationship with prospective home buyers/sellers. The strength of the relationship ebbs and flows based on agent engagement. When the client is ready to make a transaction, the relationship strengthens, and a relationship between the brokerage and the client begins to develop. In a typical brokerage, however, that brokerage/client relationship quickly fades after the initial transaction, leaving the agent with sole responsibility for driving repeat business from the client.

In contrast, in a connected brokerage, both agent and brokerage maintain strong relationships with the client. These connections support each other, creating a more consistent and valuable client experience.

In a Connected Brokerage, the initial transaction helps establish a long-term relationship between the brokerage and the client that supports and bolsters the agent and client relationship. Through ongoing core services like mortgage, insurance, title, or warranty, the brokerage has reason to continually engage with the client and reinforce the brand value. This also helps the agent keep steady client engagement, even over time.

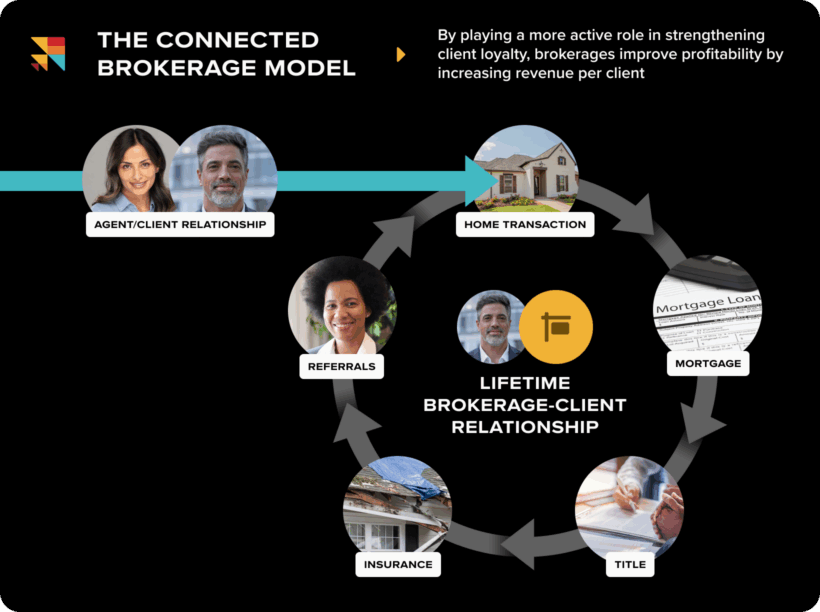

Brokerages that expand (or have already expanded) into mortgage, title, insurance, and home maintenance recognize these services not as add-ons, but as revenue engines that depend on an ongoing client relationship. Brokerages that prioritize lifetime value can create steady, recurring revenue—and in doing so, drive stronger, more sustainable profitability.

To make this happen, brokerages need to shift their mindset. Agents will always be essential, but the client—not the agent—should be the primary focus of the brokerage’s strategy and systems.

In a Connected Brokerage model, brokerages take a more active role in maintaining the client relationship, particularly if the client is a candidate for additional core services like mortgage. In this model, both the agent AND the brokerage maintain a direct relationship with the client, complementing each other depending on where the client is on their homebuying journey.

As the brand plays a more active role in driving client loyalty and lifetime value, brokerages gain efficiency and more revenue per client by driving up referrals, repeat business, and through additional services. Meanwhile, agents equally benefit from that improved brand loyalty as they reap the rewards of the increased referrals and repeat transactions.

What makes a Connected Brokerage different?

The Connected Brokerage isn’t just a tech upgrade—it’s a more profitable operating model designed to compete in the modern environment. Adopting a Connected Brokerage model isn’t about theory—it’s about operational clarity, long-term profitability, and building a business that’s ready for what’s next. Here’s how it’s different:

1. A technology stack that connects and adapts

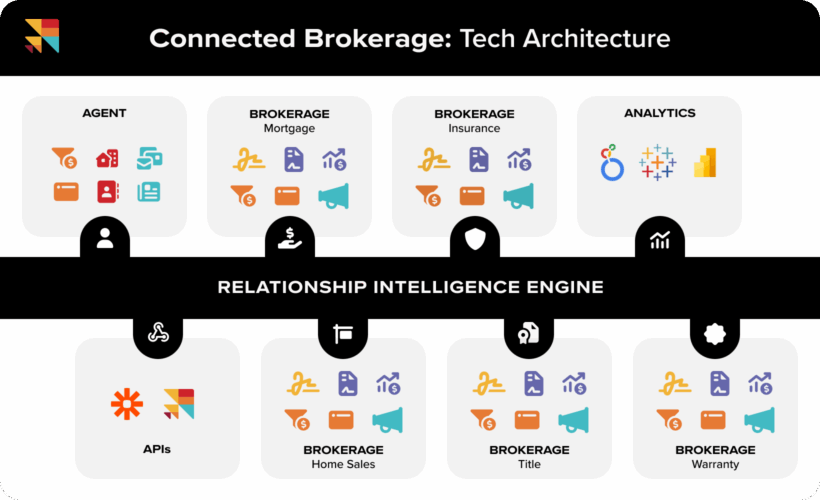

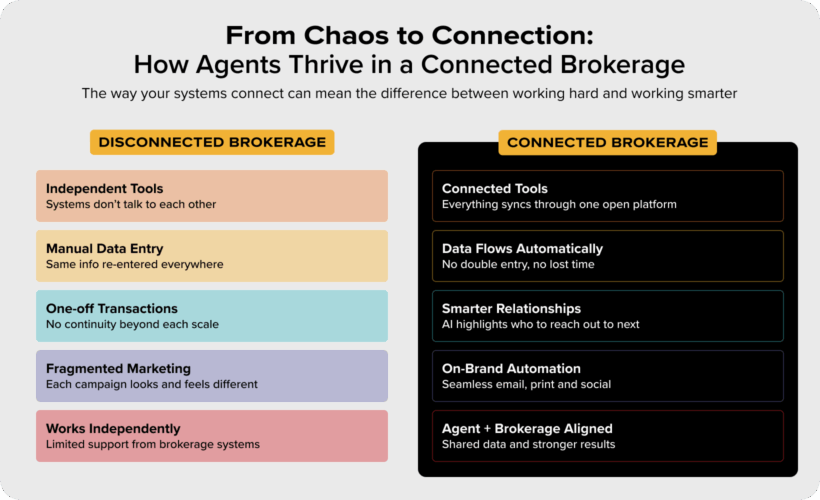

Connected brokerages don’t rely on disconnected tools—they build flexible, open systems that integrate seamlessly across the business. Powered by relationship intelligence, this approach connects data from across the organization to unlock insights.

For example, combining agent productivity data with client engagement metrics can optimize lead allocation and improve performance. This kind of integration also makes it easier to adopt new technologies, retire outdated tools, and stay agile as the market evolves.

In a Connected Brokerage, a “Relationship Intelligence Engine” serves as the connective tissue that helps data flow throughout the organization and between business units and systems, enabling the business to leverage insights, strengthen client relationships, and reduce duplicative work and manual data entry.

2. Turning scattered data into actionable insights

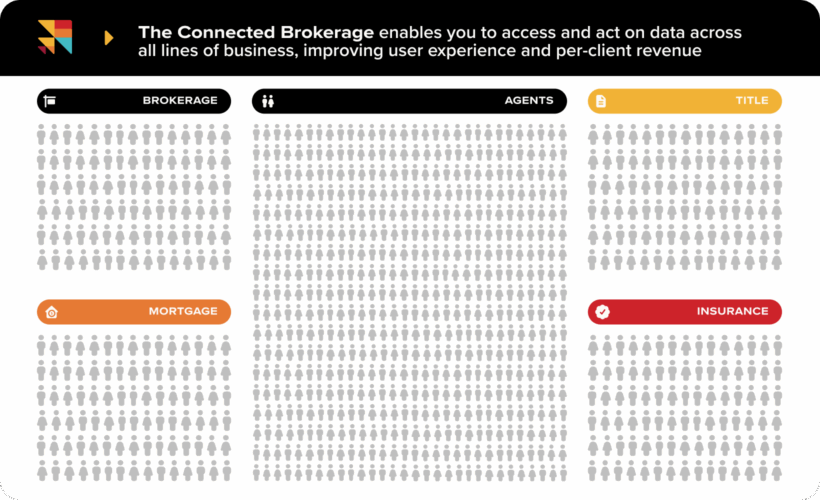

Connected brokerages bring scattered data together—transactions, client interactions, and market signals—to spot patterns and drive better decisions. With everything in one place, brokerages can personalize marketing, uncover new opportunities, and act faster.

A typical brokerage has a wealth of data spread throughout its systems and business units. In a Connected Brokerage, you can access and act on that shared data, improving user experience and increasing per-client revenue.

3. Prioritizing relationships, not just leads

While many brokerages spend heavily chasing short-term lead conversions, Connected Brokerages invest in long-term trust—building a stronger brand that delivers a steady stream of inbound leads and lowers overall client acquisition costs.

4. Building loyalty through great experiences

Serving agents and serving consumers shouldn’t be a trade-off. A Connected Brokerage does both—delivering tools that help agents succeed while elevating the client experience. That’s how loyalty is built—and retained.

5. Owning the whole homeownership journey

Connected brokerages go beyond the transaction. They build long-term relationships that span the entire homeownership lifecycle—not just the home sale. By integrating services like mortgage, title, insurance, and home services into one seamless experience, brokerages deliver more value to clients while unlocking new, recurring revenue streams.

Many of the frustrations felt by brokerage leaders and individual agents can be traced back to a disconnected tech strategy. By embracing the Connected Brokerage approach, brokerages can satisfy agent demands while driving up profit and revenue.

These aren’t add-ons—they’re core business lines. A client-first approach strengthens brand loyalty, improves retention, and positions the brokerage to earn value at every stage of the journey—not just at the closing table.

Getting started

By building and strengthening ongoing, lifetime relationships with clients, brokerages gain many more opportunities to drive revenue and profit from each relationship. But making that shift requires two changes: a change in mindset for the brokerage and a shift in technology strategy so that you have a holistic view of the client relationship from every touchpoint.

In the final blog of our three-part series, we’ll dive into the technical foundation of the Connected Brokerage, which can be implemented without a major disruptive shift to your organization.