This is the first of a three-part series introducing the Connected Brokerage model. This post introduces the imperative for change. Part 2 showcases the value of a Connected Brokerage, and Part 3 discusses how technology can make it happen. To download a pdf of the full series, click here.

Market leaders turn to the Connected Brokerage model

The residential real estate industry is at a turning point. Today’s pressure comes from all sides: regulatory shifts that hit commission structures, rising costs, and nimble competitors redefining client expectations. The result? Profit margins are shrinking, and expanding into higher-margin services like mortgage, title, and insurance is simultaneously getting both more competitive and more essential.

But this moment also brings opportunity. Many brokerages are held back by disconnected systems, outdated processes, and missed revenue. Now’s the time to streamline—and build a more focused, efficient, and client-driven operation.

Firms like Baird & Warner, BHHS Homesale, and Windermere are building stronger, more profitable businesses—with staggering results like a 36% increase in agent production and a 70% mortgage capture rate—and they’re doing it by embracing a new strategy, “The Connected Brokerage.”

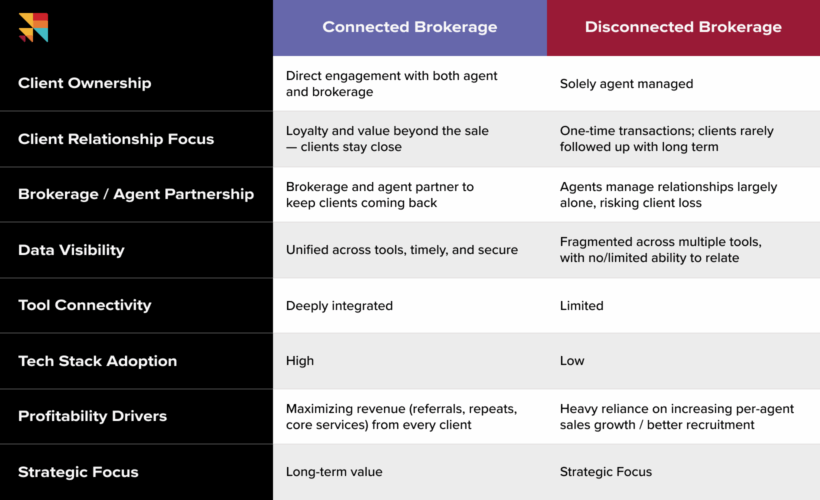

Before we get started, let’s take a look at how we’re defining the Connected Brokerage:

Connected Brokerage (noun):

A Connected Brokerage is a business model used by forward-thinking real estate firms to grow profits, build client loyalty, and stay flexible—without needing to change everything at once. It’s designed for growth, built to handle change, and focused on delivering real value throughout the client relationship.

By connecting key tools and systems—like websites, CRMs, marketing platforms, transaction tools, back-office operations, and core services—the Connected Brokerage can deliver one unified view of the business and the client.

With everything working together, brokerages can shift their focus from point-in-time transactions to long-term relationships. It allows agents and brokerages to combine personal connections with organization-wide insights, creating a more consistent and valuable client experience.

This approach helps brokerages earn more over time, especially through services like mortgage, title, and insurance. And because it’s flexible, it’s easier to adapt to shifting market conditions, regulatory changes, and rising customer expectations—without slowing down the business.

However, unlike tech shifts in the past, this isn’t a call for a full-scale tech reboot. Instead, it’s a path to smart, steady progress. By replacing legacy tools and closing gaps in processes, brokerages can increase profitability and take pressure off agents.

The Connected Brokerage empowers both the brokerage and its agents to play to their strengths—and to grow together.

In the below table, we compare some core characteristics of the “connected” brokerage with the outdated, or “disconnected” brokerage model. You can quickly begin to see how brokerages that lean into the Connected Brokerage operating model strategically set themselves up for long-term profitability.

Over the course of the next few weeks, we’ll be detailing what The Connected Brokerage is, why it’s needed, and the role technology plays. We’ll show how small changes can unlock more loyalty, more revenue, and more value from every client relationship.

In this first post, we’re going to dive into why brokerages should consider changing a familiar, decades-old model.

Chasing profitability

Real estate brokerages today are facing three roadblocks to profitability. Let’s dive into each of them.

1. Competition is fierce

With more than 2 million agents chasing fewer than 5 million annual transactions, the math doesn’t work in anyone’s favor. Agent productivity is down, and the value brokers bring is being squeezed from all sides—teams, online portals, and industry mergers are changing the rules of the game.

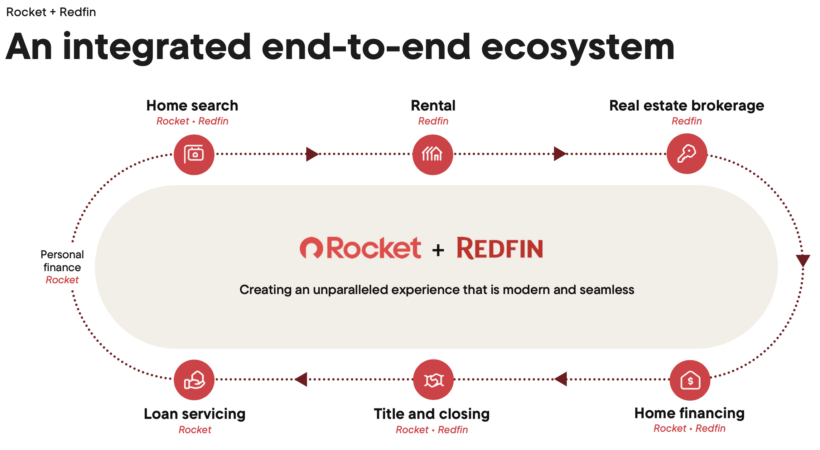

Boosting agent production isn’t enough. Brokerages need to leverage new revenue sources. Services like mortgage, title, and insurance aren’t just “ancillary” anymore—they’re core to profitability. And it’s not just brokerages eyeing these margins: Tech-driven giants like Zillow and Rocket are going after the same dollars, with data and scale on their side. In Rocket’s investor materials around the Redfin acquisition, company leadership clearly outlined the “14 petabytes of combined data” they would receive, as well as the revenue opportunities the “integrated end-to-end ecosystem” offered.

via Rocket investor presentation, courtesy of GeekWire

To compete in today’s market, a brokerage needs to think about how it can build a closer relationship with the client, improve agent performance, AND grow revenue from services like mortgage, title, and insurance—or it’s leaving money on the table.

2. New rules, new pressures

The 2024 National Association of Realtors (NAR) settlement forced every brokerage to rethink how they disclose, document, and compensate.

That puts pressure on margins—but also opens the door for smarter systems.

Connected Brokerages can automate compliance, spot market opportunities, and route leads to the right part of the business faster.

That’s real operational agility—and real upside.

3. Economic headwinds

Affordability is at a historic low. Nearly half of Americans can’t buy a $250,000 home. Interest rates are still high. And institutional buyers are scooping up homes at scale. That means fewer homes are available for everyday buyers—and fewer opportunities for agents, on both the buy and sell side.

Efficiency isn’t optional. To stay profitable, brokerages need smarter operations, lower overhead, and new ways to drive revenue from every client.

Why this is different

The economic conditions we’re facing are cyclical, and many brokerage leaders will recognize a pattern they’ve faced and overcome before. But what makes this moment particularly difficult are the other two factors:

- Regulatory changes are upending long-held expectations around revenue, commission, and profitability

- Increased competition isn’t just coming from other brokerages or even from brokerage conglomerates, but from outside the industry, well-funded giants using data and technology as their means to capture clients and develop long-term, profitable relationships with them.

Against these changes, the traditional brokerage model isn’t holding up in today’s market.

Why traditional models are falling short

The old brokerage playbook—lean on local expertise, focus on splits, prioritize agent autonomy—worked well for a long time. But it also allowed inefficiencies to pile up.

Now, those cracks are showing. Siloed data, outdated workflows, and reactive decision-making are hurting your ability to maintain margins and scale operations.

The real issue? A reactive mindset.

When agents become the primary—and sometimes, the sole—owner of the client relationship, brokerages often find that short-term, transactional wins are prioritized over the potential long-term value of a lifetime client. If brokerages can’t align agent needs with long-term customer value, they miss the opportunity to deepen the client relationship beyond the transactional sale.

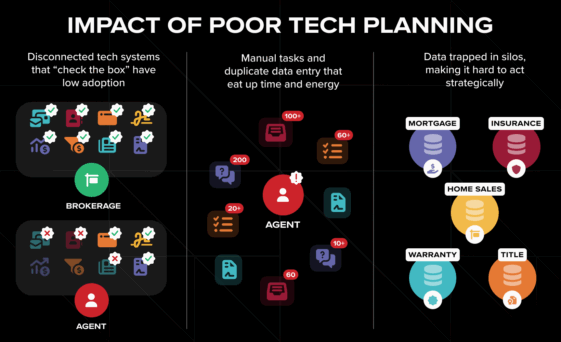

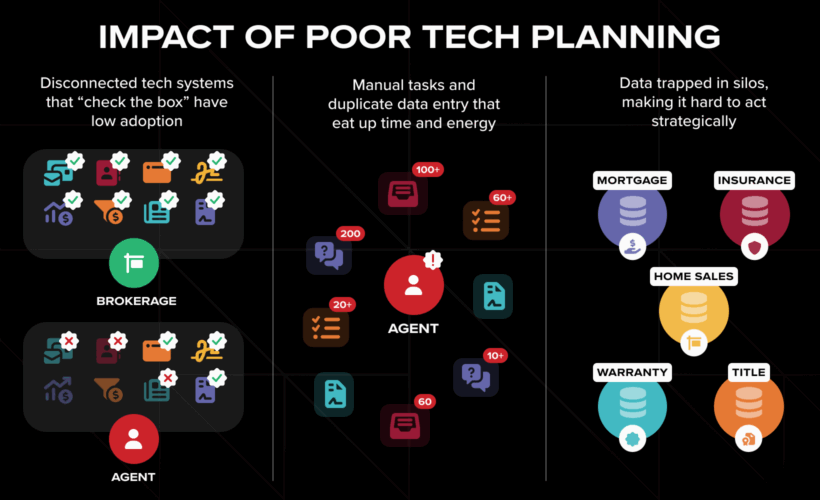

Without a clear strategy, brokerages are stuck with:

- Disconnected tech systems that don’t talk to each other

- Manual tasks that eat up time and energy

- Data trapped in silos, making it hard to spot trends or act strategically

The impact of poor tech planning: Disconnected tech systems that “check the box” for the brokerage have low agent adoption; manual tasks and duplicate date entry eat up time and energy; data gets trapped in silos, making it hard to act strategically.

Brokerages that want to grow—and stay profitable—need to shift from reacting to long-term planning. That starts by replacing outdated systems with smarter, connected ones that support both agent performance and lifetime client value.

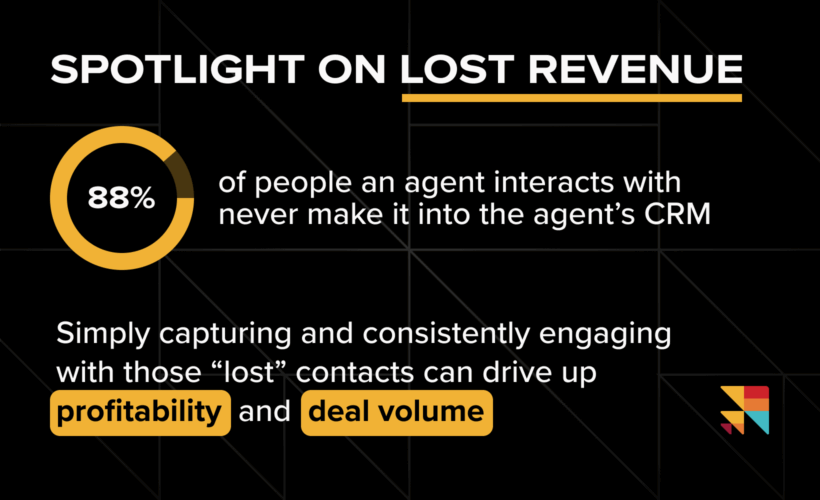

88% of people an agent interacts with never make it into an agent’s CRM. Simply capturing and consistently engaging with those “lost” contacts can drive up profitability and deal volume.

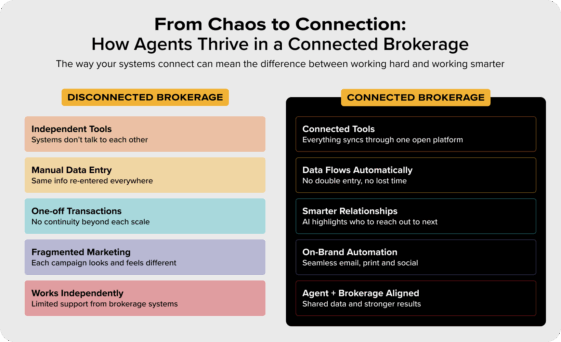

The failure of “all-in-one” platforms

“All-in-one” platforms promised simplicity—but in practice, they rarely delivered everything a brokerage needed. Too often, they simply “checked the box,” allowing leadership to say they had a tech stack in place.

But without strategic alignment, the stack that looks complete on paper falls short in execution. Leaders and agents layer in extra tools to fill gaps, resulting in added complexity. That creates new silos, more inefficiencies, and a fragmented experience for both agents and clients.

Agents feel it first.

When tools don’t meet their day-to-day needs, agents disengage—either dropping the platform or turning to alternatives. That leads to poor adoption, fractured workflows, scattered data, and ultimately a poor client experience.

The problem gets worse when the platform is “free.” That perceived savings becomes a further reason not to invest in something better—even when it’s clear the tools aren’t being used—or worse, are dragging down performance—many brokerages stick with them for the illusion of savings. And when brokerages do try to upgrade, these platforms are notoriously difficult to integrate with anything outside their own suite—creating even more friction.

That technical friction, combined with the fear of a full-system overhaul, leads to inaction, and that lack of progress cuts into profitability.

Brokerages end up in a reactive loop—always patching, never advancing.

They lose their edge, competing on fees instead of delivering a superior agent and client experience.

And that experience matters more than ever. While referrals still drive much of the business, in today’s market, brokerages need to complement an agent’s direct client relationship with a relationship to the brokerage itself. To be clear, this isn’t about displacing the agent relationship. The agent would remain the primary connection point, providing the human, real-life connection that helps drive loyalty.

However, by creating reasons to interact with the client in between home sales, the brokerage can strengthen the loyalty to both the brand and the agent, and ultimately make the most out of every client relationship. In this model, the brokerage increases profitability and efficiency by securing more revenue—through referrals, repeat business, and core service revenue—from every client, and the agent further reduces the risk of a client “forgetting” about him or her because of the strengthened relationship with the brokerage brand.

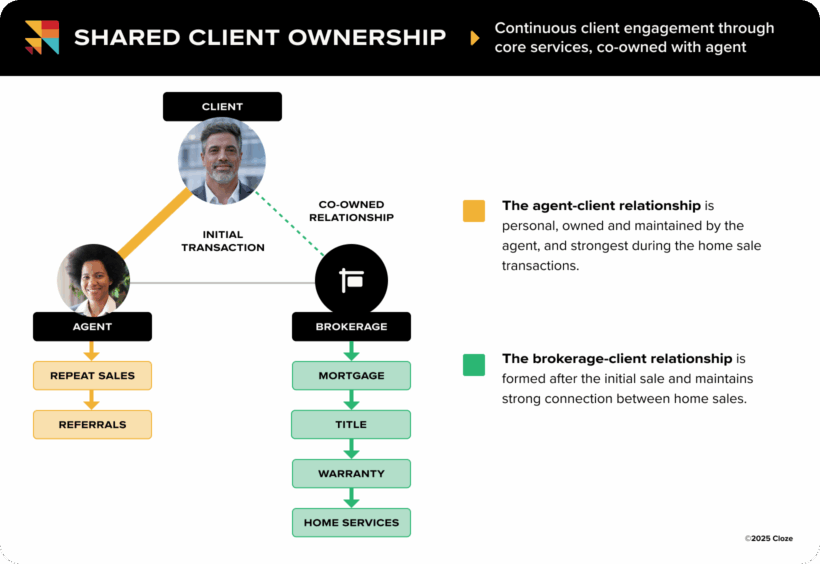

In a connected brokerage, the agent maintains the relationship throughout the homebuying process, but after the first time the client purchases or sells a home, the brokerage has an opportunity to strengthen the relationship through ongoing services.

With all that in mind, supporting agents with a smart, connected tech strategy isn’t just an upgrade—it’s a growth imperative.

In our next post, we’re going to dive into the “Connected Brokerage” and how brokerages can drive growth and profitability despite today’s market challenges. Part 3 of our series will highlight the technology that can make it all happen.